Difference between revisions of "Programming/Kdb/Labs/Exploratory data analysis"

| (6 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

=Getting hold of data= | =Getting hold of data= | ||

In this lab we'll make sense of the following data set from the | In this lab we'll make sense of the following data set from the [https://archive.ics.uci.edu/ml/index.php UCI Machine Learning Repository]: | ||

* '''Name:''' Real estate valuation data set | * '''Name:''' Real estate valuation data set | ||

| Line 17: | Line 17: | ||

** Yeh, I.C., and Hsu, T.K. (2018). Building real estate valuation models with comparative approach through case-based reasoning. Applied Soft Computing, 65, 260-271. | ** Yeh, I.C., and Hsu, T.K. (2018). Building real estate valuation models with comparative approach through case-based reasoning. Applied Soft Computing, 65, 260-271. | ||

* '''URL:''' | * '''URL:''' https://archive.ics.uci.edu/ml/datasets/Real+estate+valuation+data+set | ||

There are many data sets on UCI that are worth exploring. We picked this one because it is relatively straightforward and clean. | There are many data sets on UCI that are worth exploring. We picked this one because it is relatively straightforward and clean. | ||

| Line 48: | Line 48: | ||

=Downloading the data set and converting it to CSV= | =Downloading the data set and converting it to CSV= | ||

The data set can be downloaded from the data folder | The data set can be downloaded from the data folder https://archive.ics.uci.edu/ml/machine-learning-databases/00477/. The data is supplied in the form of an excel file, <tt>Real estate valuation data set.xlsx</tt>. In order to export this data to kdb+/q, we convert it to the '''comma-separated values (CSV)''' format: | ||

* start Excel; | * start Excel; | ||

* File > Open the file <tt>Real estate valuation data set.xlsx</tt>; | * File > Open the file <tt>Real estate valuation data set.xlsx</tt>; | ||

| Line 201: | Line 201: | ||

</pre> | </pre> | ||

More advanced rules can be found in the library quantQ: | More advanced rules can be found in the library quantQ: https://github.com/hanssmail/quantQ | ||

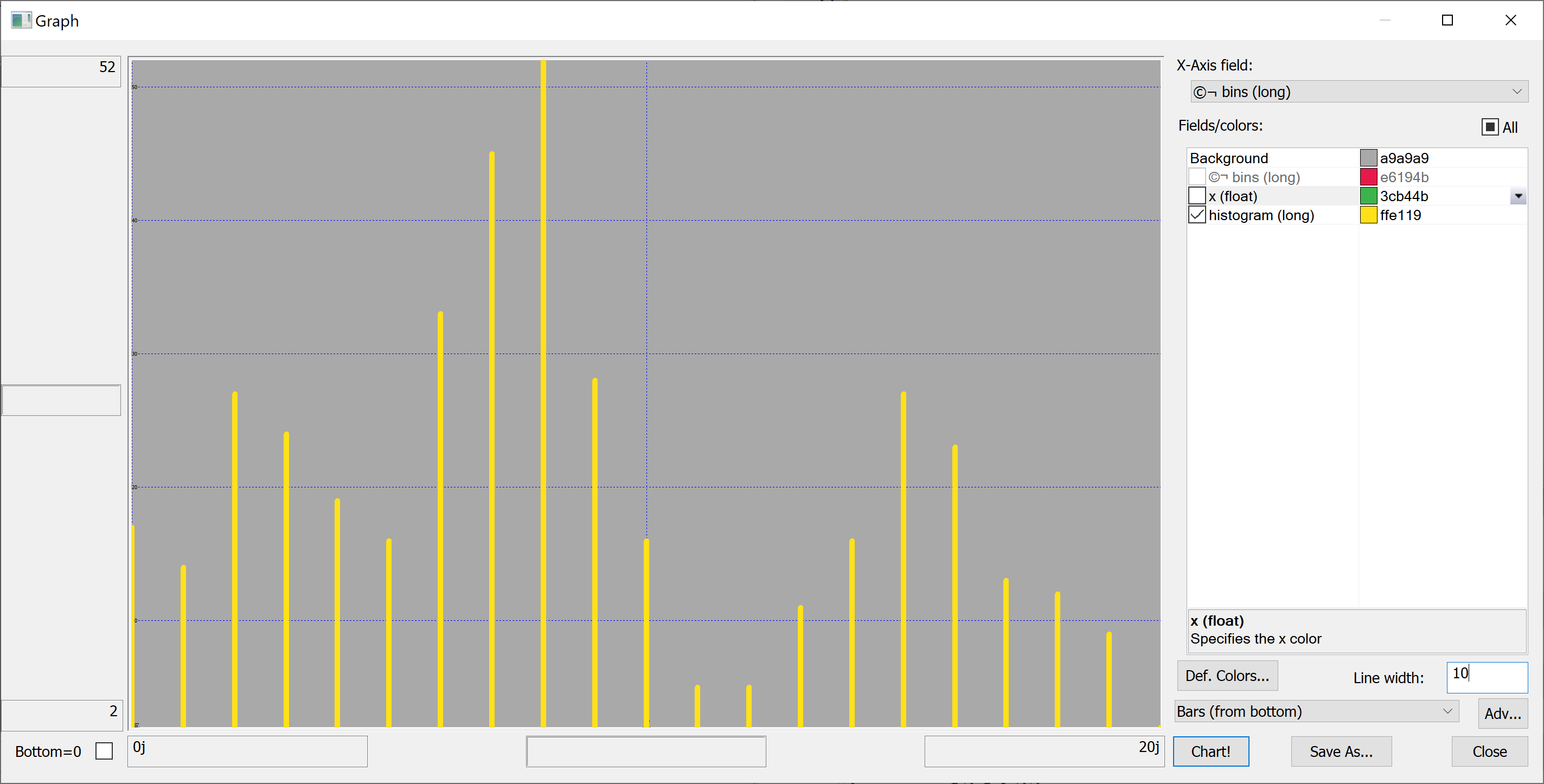

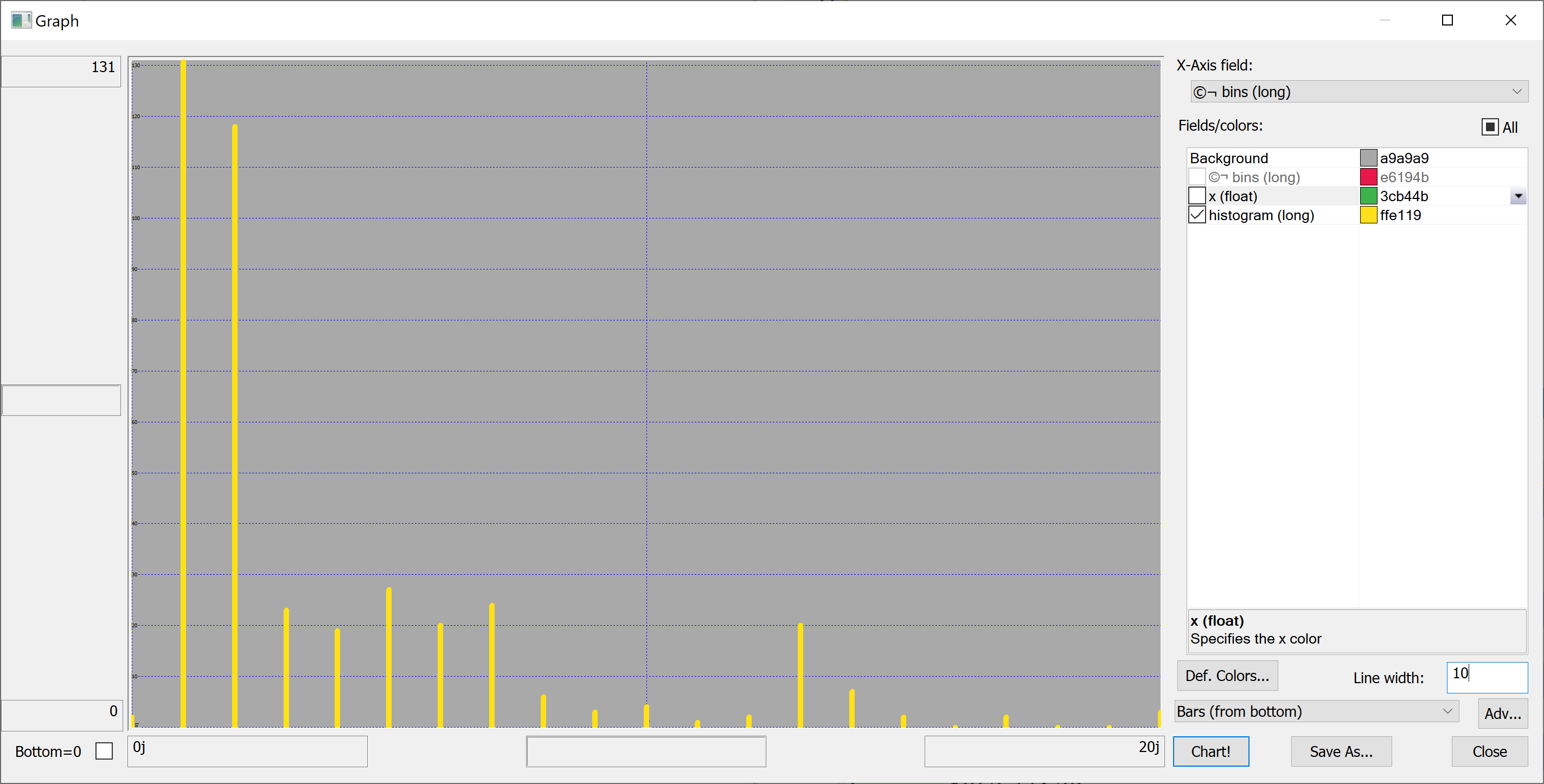

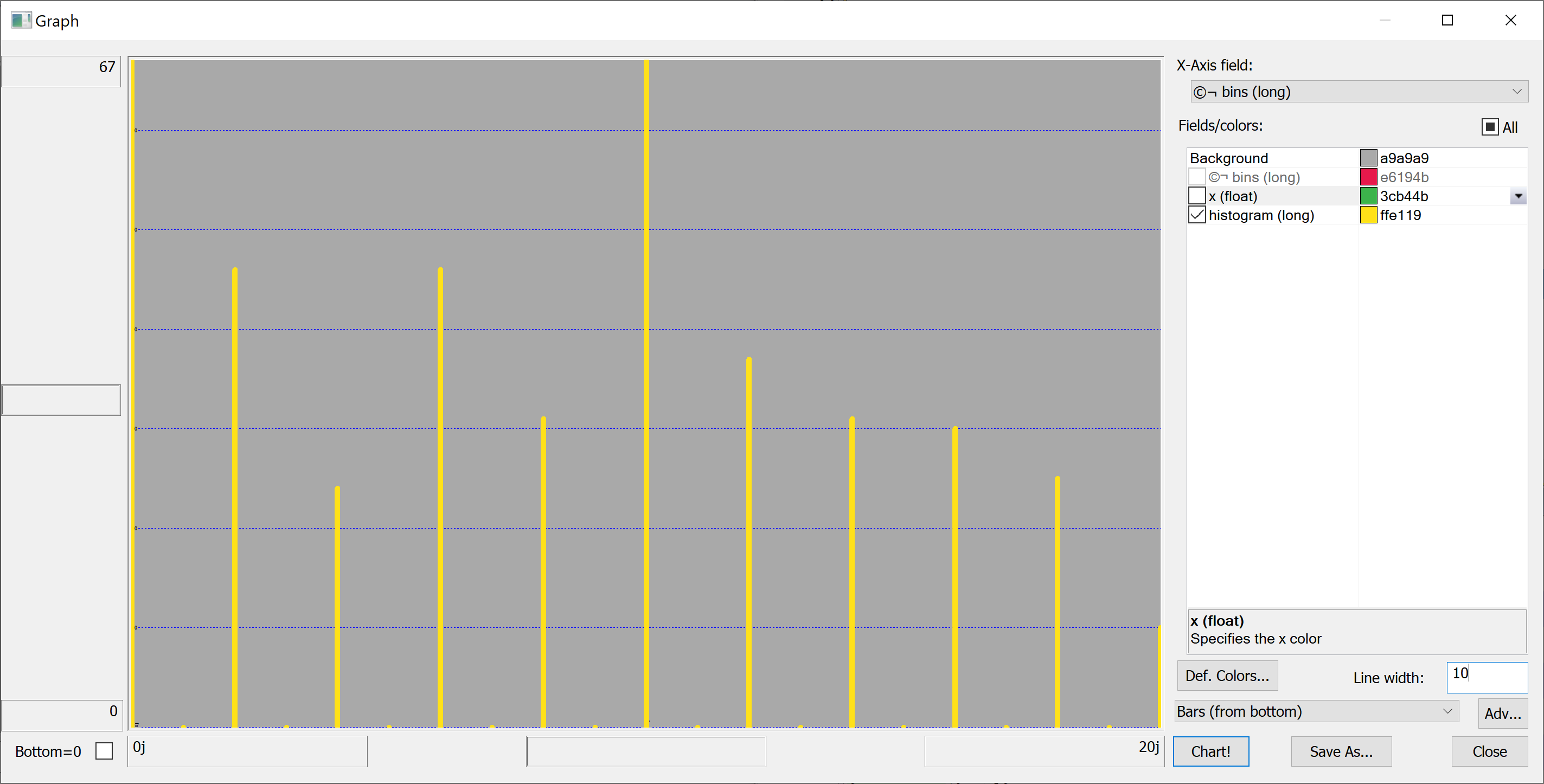

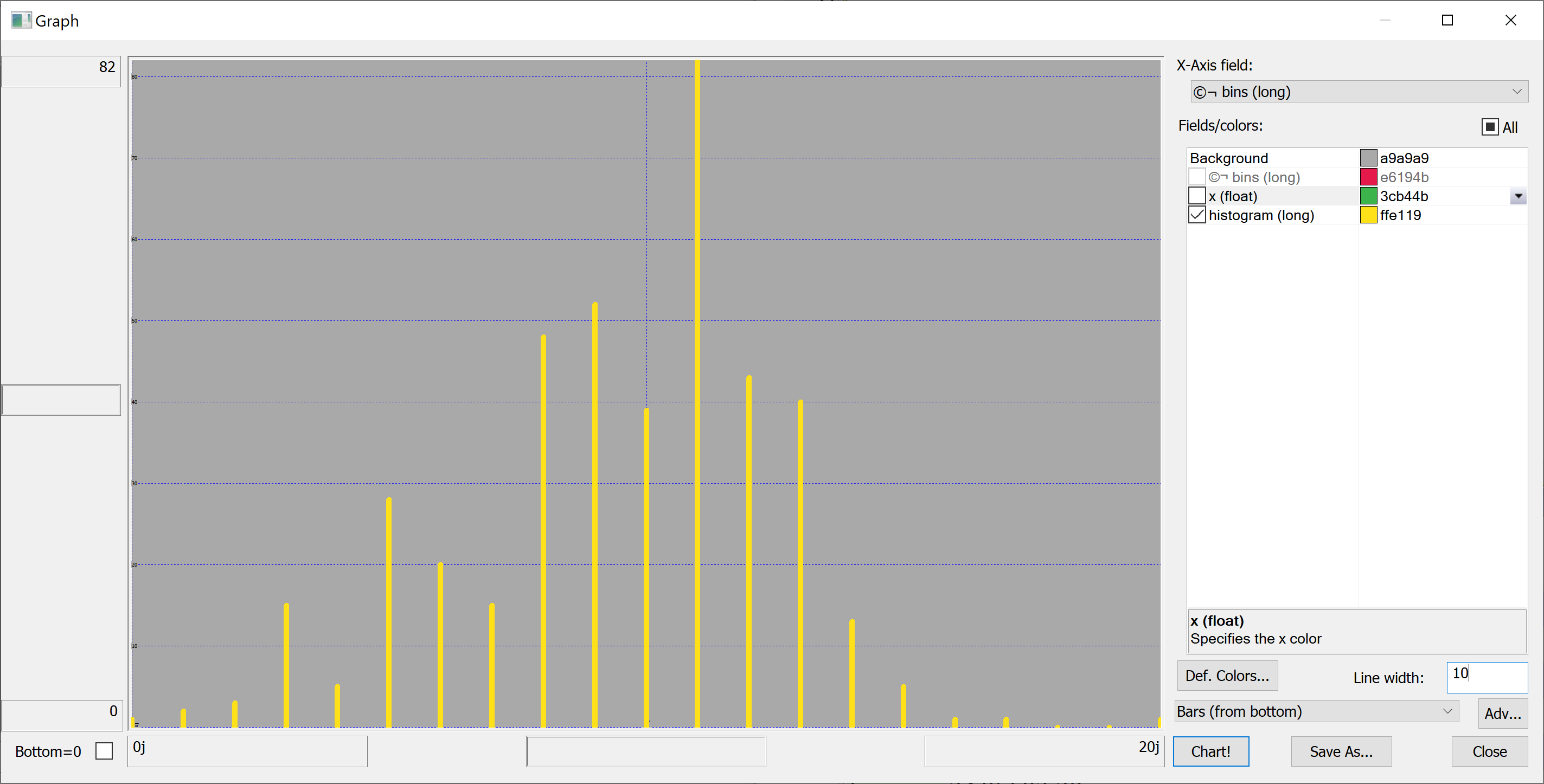

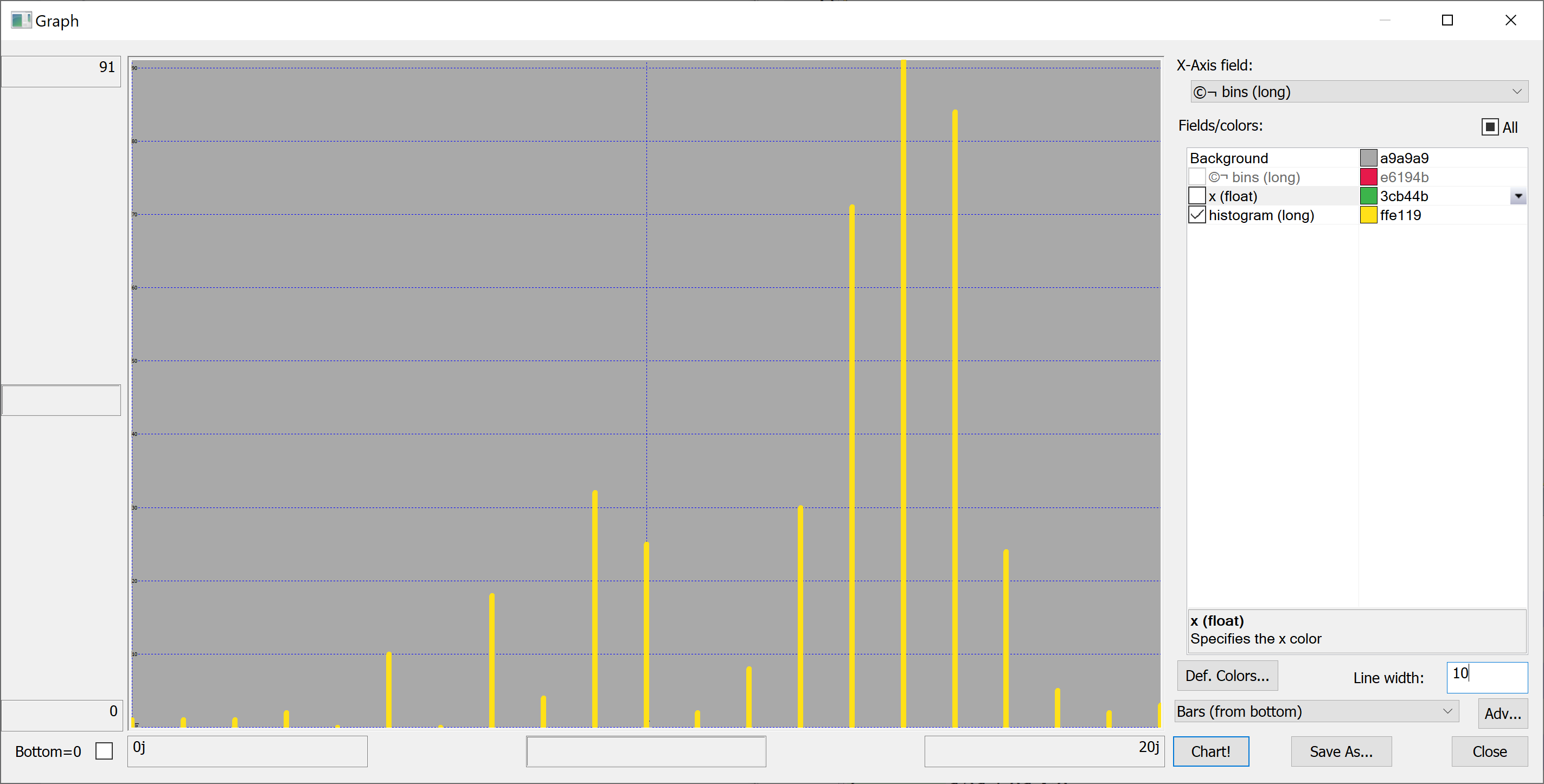

Equipped with this code, we can plot the histograms: | Equipped with this code, we can plot the histograms: | ||

| Line 448: | Line 448: | ||

flip `y_train`y_train_pred!(y_train;y_train_pred) | flip `y_train`y_train_pred!(y_train;y_train_pred) | ||

</pre> | </pre> | ||

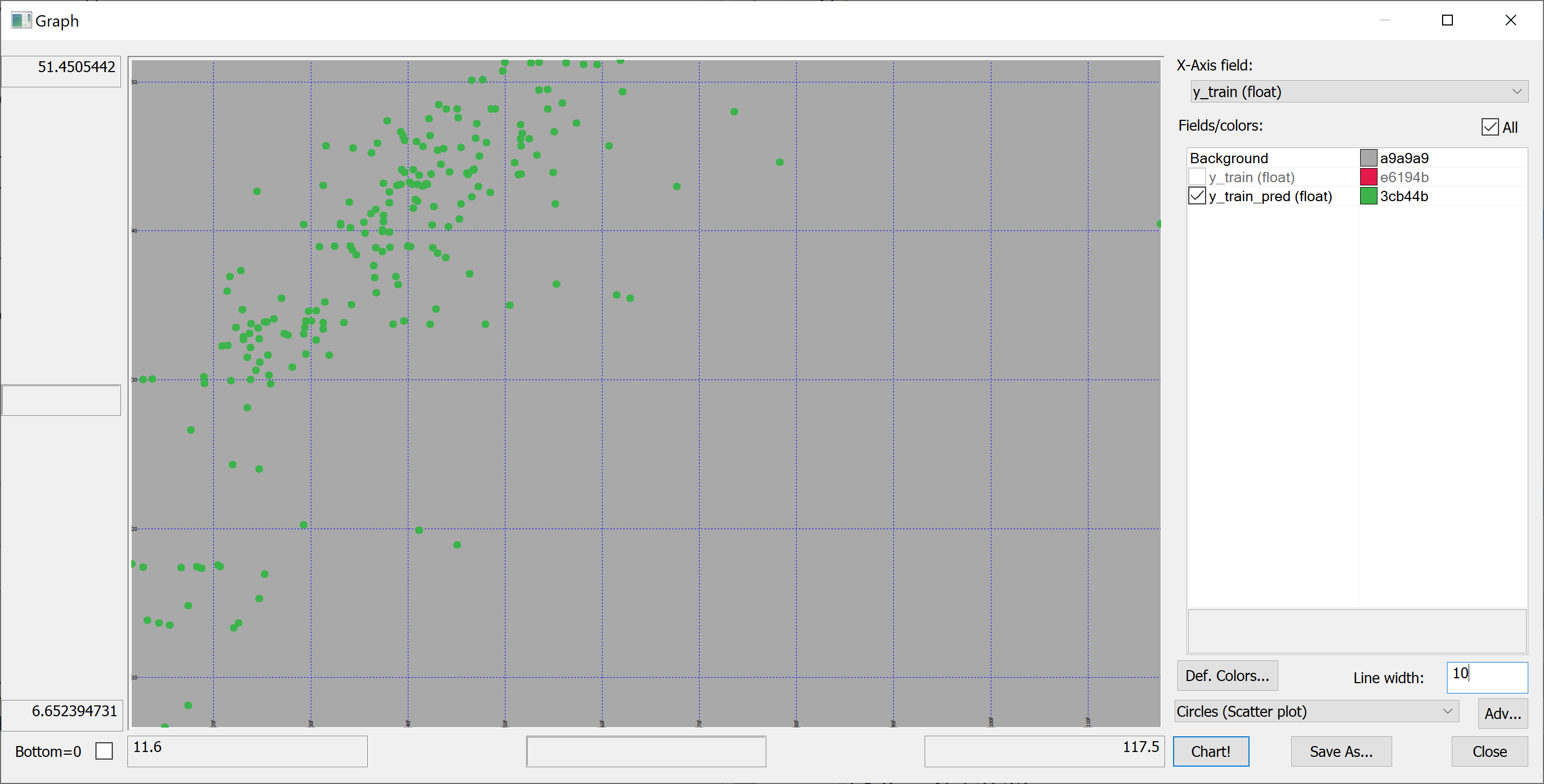

[[File:scatter_plot_in_sample.png]] | |||

Out-of-sample: | Out-of-sample: | ||

| Line 453: | Line 455: | ||

flip `y_test`y_test_pred!(y_test;y_test_pred) | flip `y_test`y_test_pred!(y_test;y_test_pred) | ||

</pre> | </pre> | ||

[[File:scatter_plot_out_of_sample.png]] | |||

On the in-sample scatter plot we see the outlier (the rightmost point on the plot). This outlier is likely affecting the in-sample <math>R^2</math>. Let's find this outlier: | |||

<pre> | |||

select from t_train where (max abs y_train_pred-y_train)=abs y_train_pred-y_train | |||

</pre> | |||

<pre> | |||

no transaction_date house_age distance_to_nearest_mrt number_of_convenience_stores latitude longitude house_price_per_unit_area | |||

-------------------------------------------------------------------------------------------------------------------------------- | |||

271 2013.333 10.8 252.5822 1 24.9746 121.5305 117.5 | |||

</pre> | |||

This outlier corresponds to a property with an unusually high <tt>house_price_per_unit_area</tt>. We can even find this property on Google Maps (by entering the latitude and longitude). | |||

Let's remove this outlier: | |||

<pre> | |||

delete from `t_train where (max abs y_train_pred-y_train)=abs y_train_pred-y_train; | |||

x_train:flip`float$t_train[-1_2_cols t_train]; | |||

y_train:raze t_train[-1#cols t_train]; | |||

</pre> | |||

Now let's repeat the fitting procedure: | |||

<pre> | |||

model:ols_fit[x_train;y_train]; | |||

y_train_pred:ols_predict[model;x_train]; | |||

r_squared[y_train;y_train_pred] | |||

</pre> | |||

Now we obtain the in-sample <math>R^2</math> of 0.5706795 (approx. 57%). What about out-of-sample? | |||

<pre> | |||

y_test_pred:ols_predict[model;x_test]; | |||

r_squared[y_test;y_test_pred] | |||

</pre> | |||

0.5941468 (approx. 59%). Still (somewhat surprisingly) greater than in-sample, but much closer. | |||

=Combining q and Python: improving on OLS= | |||

Can we do better than that? | |||

For some things q is perfect (e.g. working with big data), whereas others are best reserved for Python (and especially its excellent machine learning libraries). We'll now use Python to improve on the results of the OLS regression. | |||

We'll use the <tt>qpython</tt> module to interact with q from Python. We install it using | |||

<pre> | |||

pip install qpython | |||

</pre> | |||

XGBoost is advertised as | |||

<blockquote> | |||

an optimized distributed gradient boosting library designed to be highly '''efficient''', '''flexible''' and '''portable'''. It implements machine learning algorithms under the Gradient Boosting framework. XGBoost provides a parallel tree boosting (also known as GBDT, GBM) that solve many data science problems in a fast and accurate way. The same code runs on major distributed environment (Hadoop, SGE, MPI) and can solve problems beyond billions of examples. | |||

</blockquote> | |||

[https://en.wikipedia.org/wiki/Gradient_boosting Wikipedia] tells us that '''gradient boosting''' | |||

<blockquote> | |||

is a machine learning technique for regression, classification and other tasks, which produces a prediction model in the form of an ensemble of weak prediction models, typically decision trees. When a decision tree is the weak learning, the resulting algorithm is called gradient boosted trees, which usually outperforms random forest. It builds the model in a stage-wise fashion like other boosting methods do, and it generalizes them by allowing optimization of an arbitrary differentiable loss function. | |||

</blockquote> | |||

Let's install XGBoost: | |||

<pre> | |||

pip install xgboost | |||

</pre> | |||

We start a Jupyter notebook and import the following Python modules: | |||

<pre> | |||

import numpy as np | |||

import qpython.qconnection | |||

import sklearn.metrics | |||

import xgboost | |||

</pre> | |||

We want Python to be able to talk to kdb+/q. To this end, in q, we open a port: | |||

<pre> | |||

\p 41822 | |||

</pre> | |||

We connect to this port from the Python side: | |||

<pre> | |||

q = qpython.qconnection.QConnection('localhost', 41822, pandas=True) | |||

q.open() | |||

</pre> | |||

We fetch the data set from q to Python: | |||

<pre> | |||

x_train = np.array(q('x_train')) | |||

y_train = np.array(q('y_train')) | |||

x_test = np.array(q('x_test')) | |||

y_test = np.array(q('y_test')) | |||

</pre> | |||

We then create an XGBoost model with default parameters (let's see how well XGBoost works out of the box): | |||

<pre> | |||

model = xgboost.XGBRegressor() | |||

</pre> | |||

and fit this model to the data: | |||

<pre> | |||

model.fit(x_train, y_train) | |||

</pre> | |||

The model is then used to obtain the predictions <tt>y_train_pred</tt>: | |||

<pre> | |||

y_train_pred = model.predict(x_train) | |||

</pre> | |||

How good is the fit? What is our in-sample <math>R^2</math>? | |||

<pre> | |||

sklearn.metrics.r2_score(y_train, y_train_pred) | |||

</pre> | |||

The result is | |||

<pre> | |||

0.9955447127025048 | |||

</pre> | |||

Of course, we are interested in the out-of-sample, rather than in-sample, performance of the model. Let's apply the model to the test set: | |||

<pre> | |||

y_test_pred = model.predict(x_test) | |||

</pre> | |||

What's our out out-of-sample <math>R^2</math>? | |||

<pre> | |||

sklearn.metrics.r2_score(y_test, y_test_pred) | |||

</pre> | |||

<pre> | |||

0.7187695555297899 | |||

</pre> | |||

The out-of-sample <math>R^2</math> of about 72% is significantly better than that produced using the OLS regression. | |||

Latest revision as of 22:13, 21 December 2021

Getting hold of data

In this lab we'll make sense of the following data set from the UCI Machine Learning Repository:

- Name: Real estate valuation data set

- Data Set Characteristics: Multivariate

- Attribute Characteristics: Integer, Real

- Associated Tasks: Regression

- Number of Instances: 414

- Number of Attributes: 7

- Missing Values? N/A

- Area: Business

- Date Donated: 2018.08.18

- Number of Web Hits: 111,613

- Original Owner and Donor: Prof. I-Cheng Yeh, Department of Civil Engineering, Tamkang University, Taiwan

- Relevant papers:

- Yeh, I.C., and Hsu, T.K. (2018). Building real estate valuation models with comparative approach through case-based reasoning. Applied Soft Computing, 65, 260-271.

There are many data sets on UCI that are worth exploring. We picked this one because it is relatively straightforward and clean.

Let's read the data set information:

The market historical data set of real estate valuation is collected from Sindian Dist., New Taipei City, Taiwan. The real estate valuation is a regression problem. The data set was randomly split into the training data set (2/3 samples) and the testing data set (1/3 samples).

This paragraph describes how the original researchers split up the data set. We will split it up differently: fifty-fifty.

Let's read on:

The inputs are as follows:

- X1 = the transaction date (for example, 2013.25=2013 March, 2013.500=2013 June, etc.)

- X2 = the house age (unit: year)

- X3 = the distance to the nearest MRT station (unit: metre)

- X4 = the number of convenience stores in the living circle on foot (integer)

- X5 = the geographic coordinate, latitude (unit: degree)

- X6 = the geographic coordinate, longitude (unit: degree)

The output is as follows:

- Y = house price per unit area (10000 New Taiwan Dollar/Ping, where Ping is a local unit, 1 Ping = 3.3 square metres)

Downloading the data set and converting it to CSV

The data set can be downloaded from the data folder https://archive.ics.uci.edu/ml/machine-learning-databases/00477/. The data is supplied in the form of an excel file, Real estate valuation data set.xlsx. In order to export this data to kdb+/q, we convert it to the comma-separated values (CSV) format:

- start Excel;

- File > Open the file Real estate valuation data set.xlsx;

- File > Save As, set "Save as type" to "CSV (Comma delimited)", click "Save".

Opening the data set in kdb+/q

We read in the resulting CSV file as a kdb+/q table:

t:("HFFFHFFF";enlist",")0:`$":S:/dev/bodleian/teaching/kdb-q/Real estate valuation data set.csv"

(Here you need to replace our path with the corresponding path on your machine.)

We have specified the type for each column as "HFFFHFFF". Here "H" stands for short and "F" stands for float.

We can examine the meta data for the resulting table with

meta t

The result:

c | t f a --------------------------------------| ----- No | h X1 transaction date | f X2 house age | f X3 distance to the nearest MRT station| f X4 number of convenience stores | h X5 latitude | f X6 longitude | f Y house price of unit area | f

It's somewhat inconvenient to work in q with table column names containing spaces, so we rename the columns as follows:

t:`no`transaction_date`house_age`distance_to_nearest_mrt`number_of_convenience_stores`latitude`longitude`house_price_per_unit_area xcol t

We check the meta data again:

meta t

The result:

c | t f a ----------------------------| ----- no | h transaction_date | f house_age | f distance_to_nearest_mrt | f number_of_convenience_stores| h latitude | f longitude | f house_price_per_unit_area | f

Producing the time series plot of house_price_per_unit_area

We look at the first 10 rows

select[10] from t

no transaction_date house_age distance_to_nearest_mrt number_of_convenience_s.. -----------------------------------------------------------------------------.. 1 2012.917 32 84.87882 10 .. 2 2012.917 19.5 306.5947 9 .. 3 2013.583 13.3 561.9845 5 .. 4 2013.5 13.3 561.9845 5 .. 5 2012.833 5 390.5684 5 .. 6 2012.667 7.1 2175.03 3 .. 7 2012.667 34.5 623.4731 7 .. 8 2013.417 20.3 287.6025 6 .. 9 2013.5 31.7 5512.038 1 .. 10 2013.417 17.9 1783.18 3 ..

and observe that the data is not sorted by transaction_date. We therefore sort it by transaction_date (in-place, hence `t and not t in the following command):

`transaction_date xasc `t

meta t reveals that the data is now sorted by transaction_date:

meta t

c | t f a ----------------------------| ----- no | h transaction_date | f s house_age | f distance_to_nearest_mrt | f number_of_convenience_stores| h latitude | f longitude | f house_price_per_unit_area | f

We see that the transaction_date now has the "sorted" (s) attribute (a).

Here is our first attempt to produce a time series plot of house_price_per_unit_area:

select transaction_date, house_price_per_unit_area from t

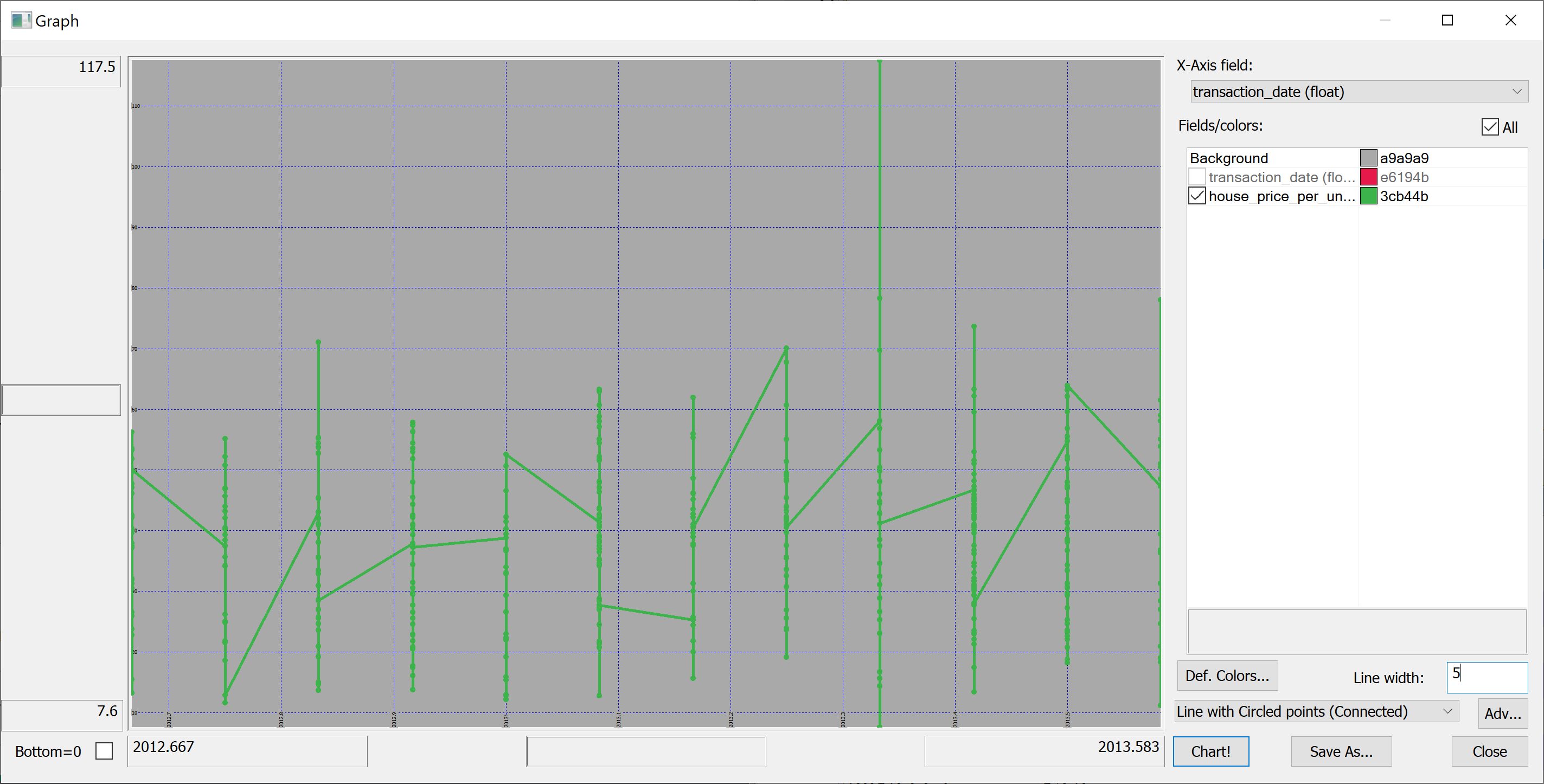

The resulting plot is confusing because the transaction_date is bucketed into (floating point) months:

(Here we have used Q Insight Pad to plot the results of a q-sql query.)

Can we do better?

Perhaps we could build something on the basis of

select house_price_per_unit_area by transaction_date from t

We could produce the plot of the mean house_price_per_unit_area in any given month:

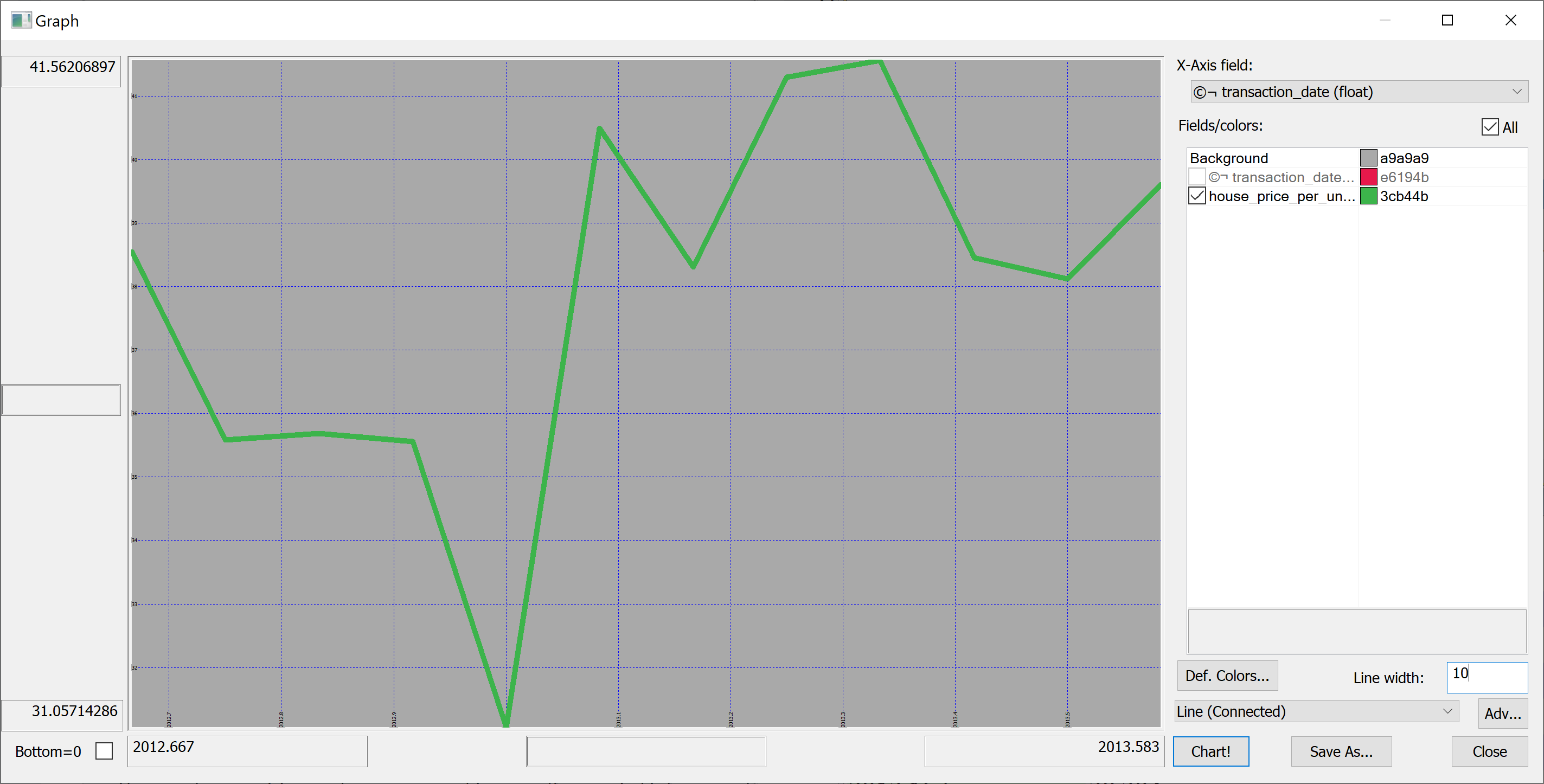

select avg house_price_per_unit_area by transaction_date from t

Looking at this plot, it appears that the house prices dropped towards the start of 2013 and then sharply increased again. However, we don't know the uncertainties. We could produce a plot of the mean house prices in any given month +/- one standard deviation:

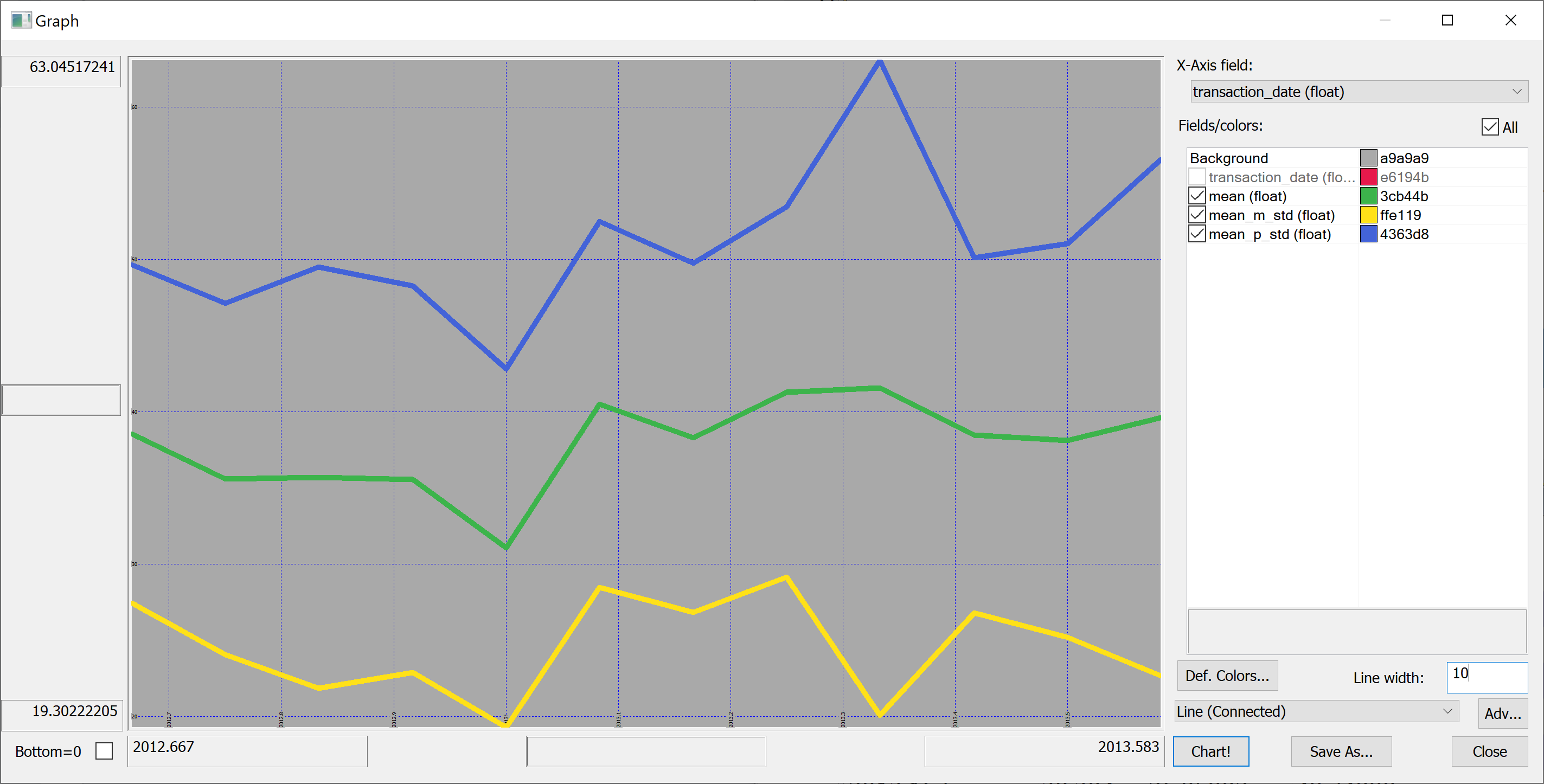

select transaction_date,mean,mean_m_std:mean-std,mean_p_std:mean+std from select mean:avg house_price_per_unit_area,std:sqrt var house_price_per_unit_area by transaction_date from t

Perhaps we shouldn't jump to conclusions regarding the increase / decrease of the house prices over time: the standard deviation is quite high.

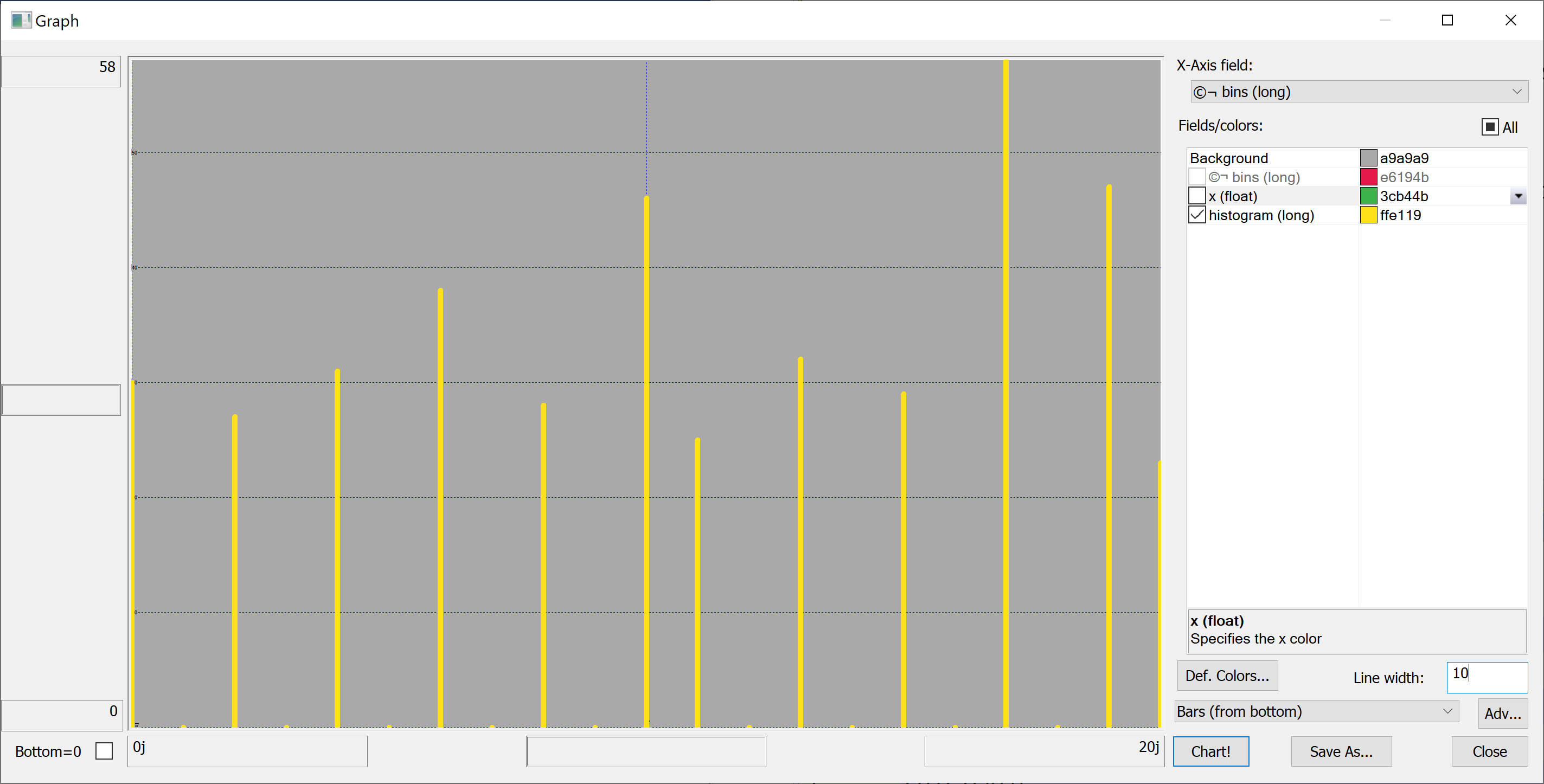

Histograms

In order to better understand the data we need to plot some histograms. We define the following function:

getHistogram:{[data;rule]

/ data - array of data

/ rule - function which takes data and returns bins

bins: rule data;

update 0^histogram from

([bins:asc til count[bins]] x:bins) uj

(select histogram: count bins by bins from ([] bins:bins binr data))};

This function takes as a parameter a rule — a function that takes the data and returns the bins. We'll use a very simple rule:

histBin:{[n;data]

/ n - number of bins

/ data - array of data

min[data]+((max[data]-min[data])%n)*til 1+n};

More advanced rules can be found in the library quantQ: https://github.com/hanssmail/quantQ

Equipped with this code, we can plot the histograms:

getHistogram[t[`transaction_date];histBin[20]]

getHistogram[t[`house_age];histBin[20]]

getHistogram[t[`distance_to_nearest_mrt];histBin[20]]

getHistogram[`float$t[`number_of_convenience_stores];histBin[20]]

getHistogram[t[`latitude];histBin[20]]

getHistogram[t[`longitude];histBin[20]]

getHistogram[t[`house_price_per_unit_area];histBin[20]]

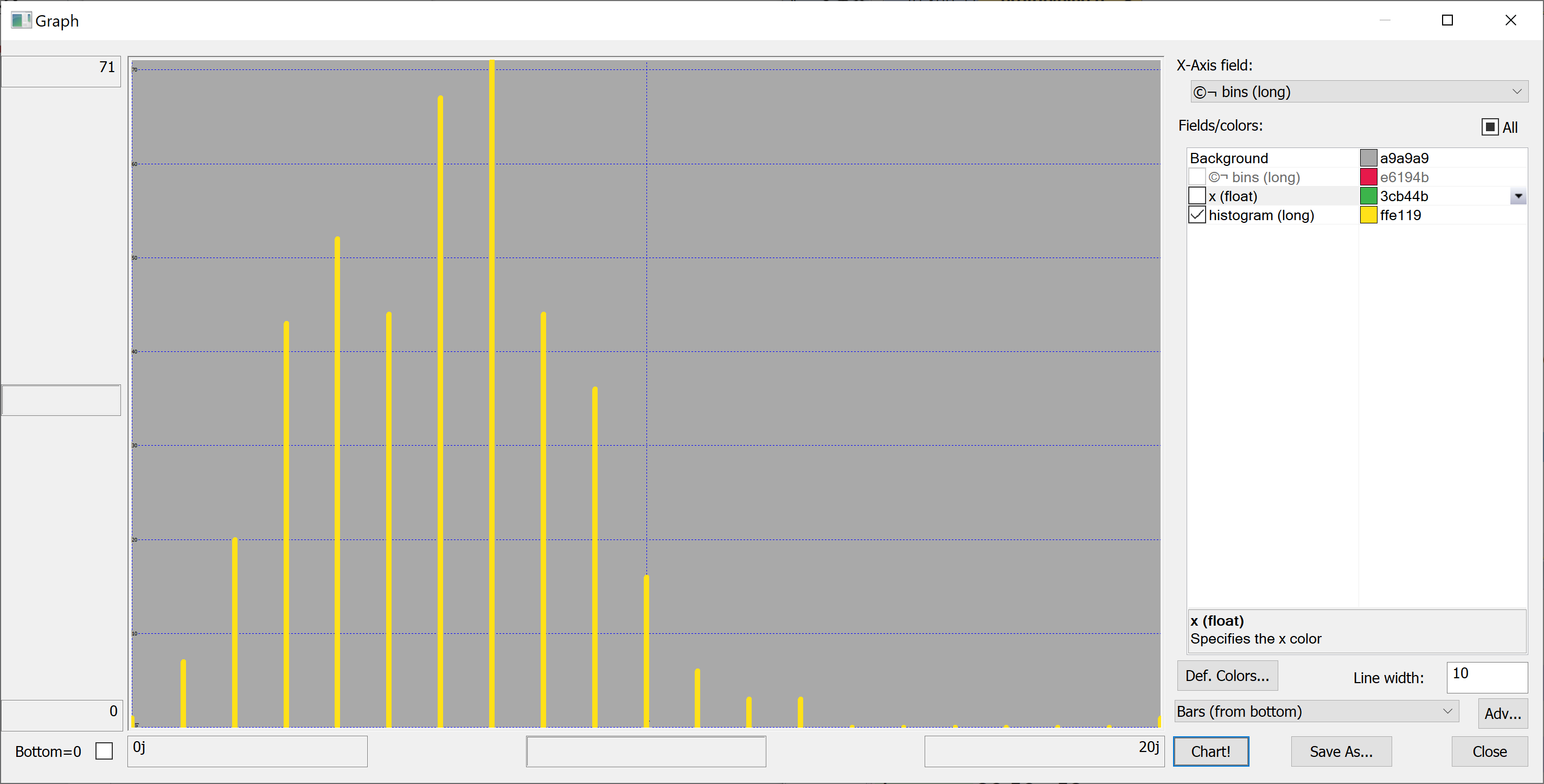

A map

Since we have columns containing the longitude and latitude of each property, we can produce a map of all properties in the data set:

select longitude,latitude from t

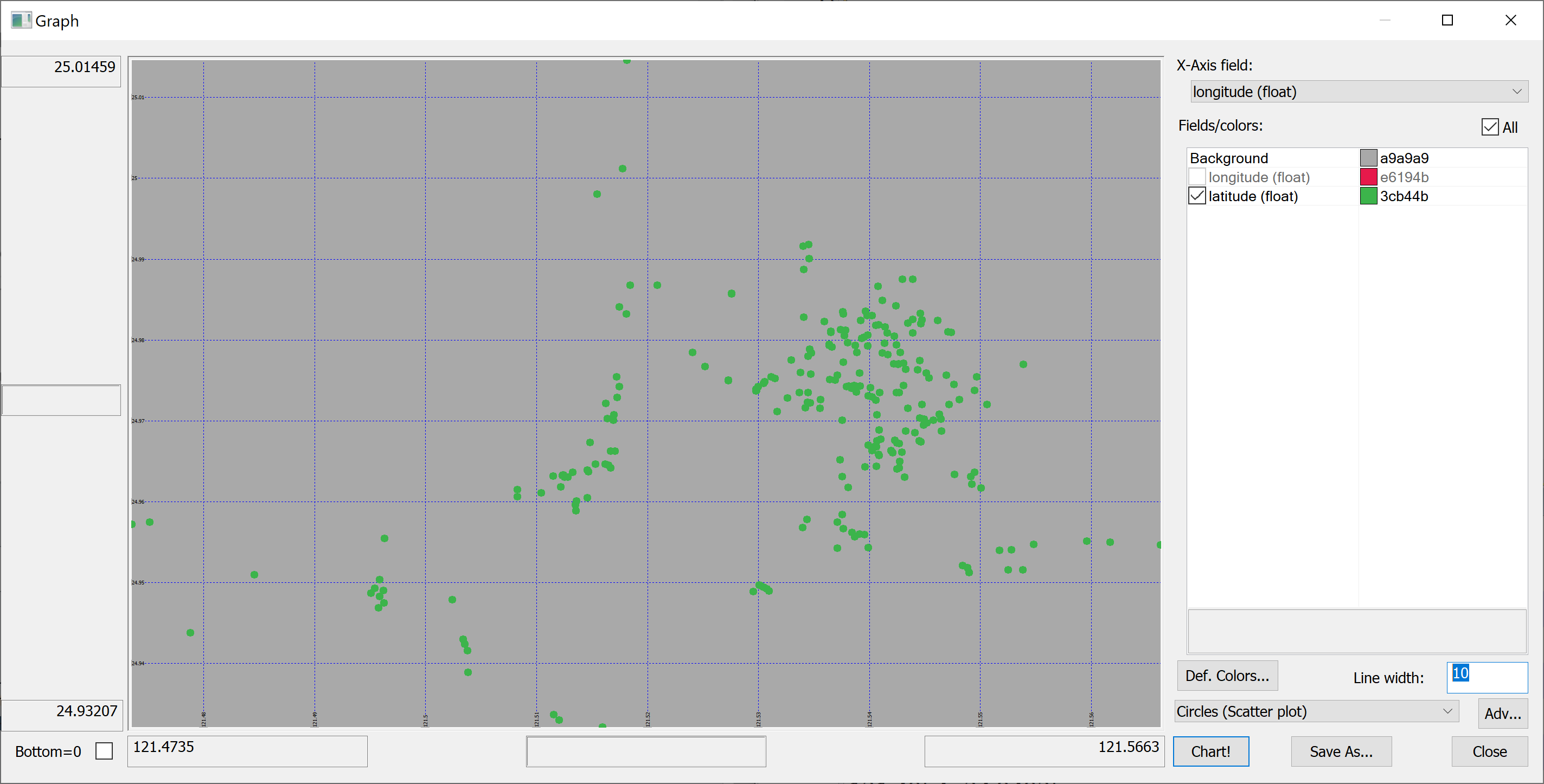

Scatter plots

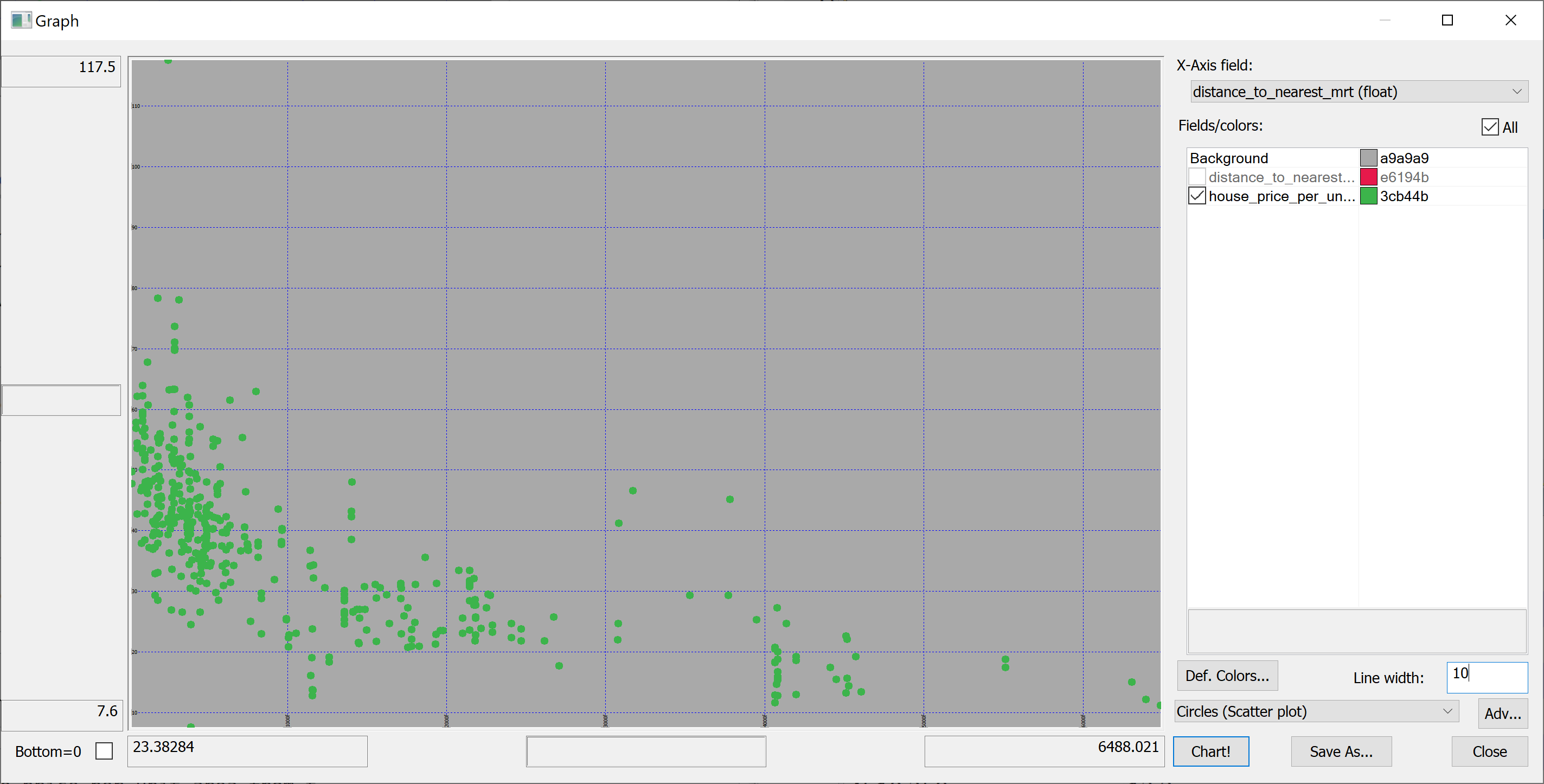

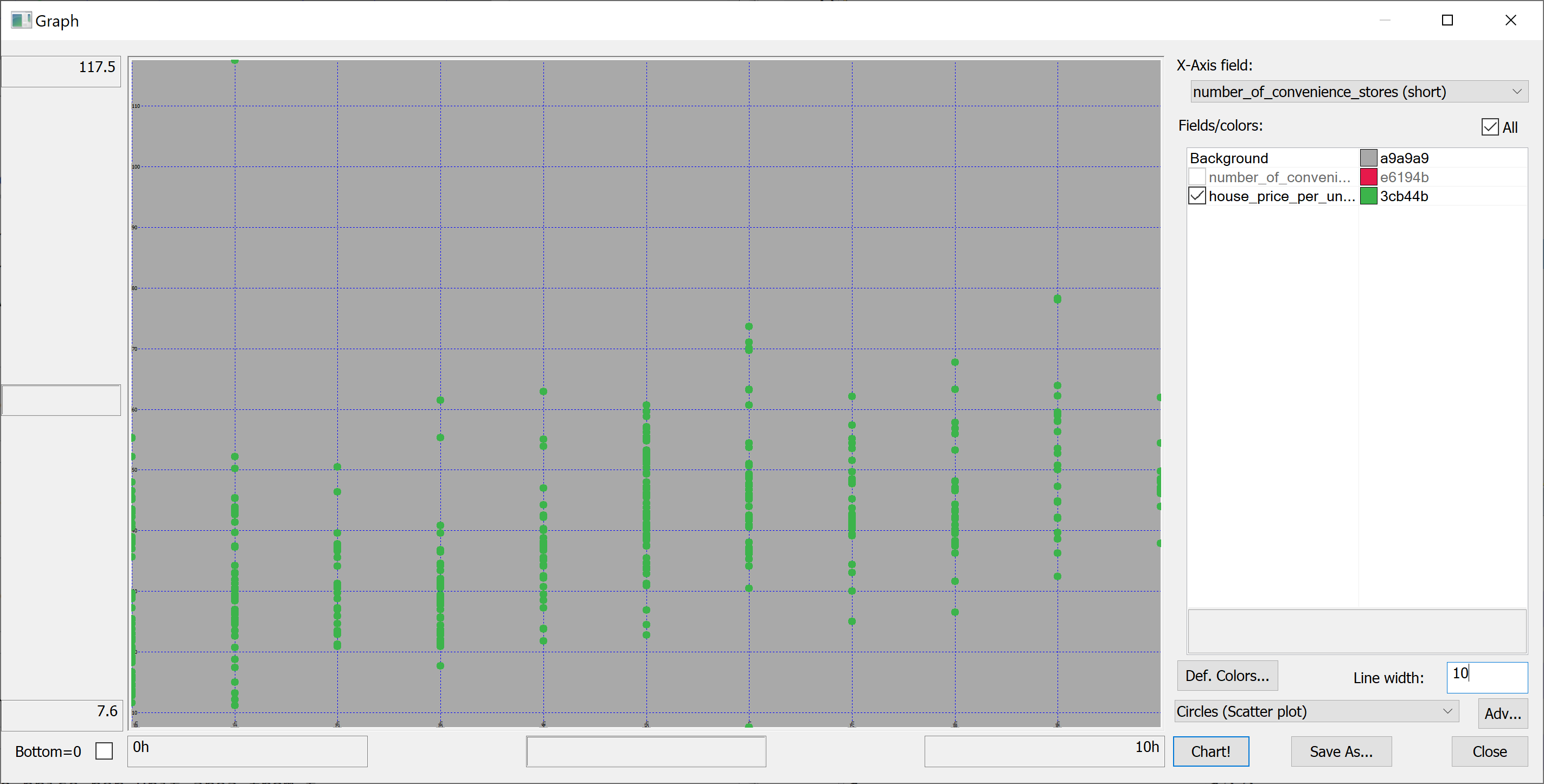

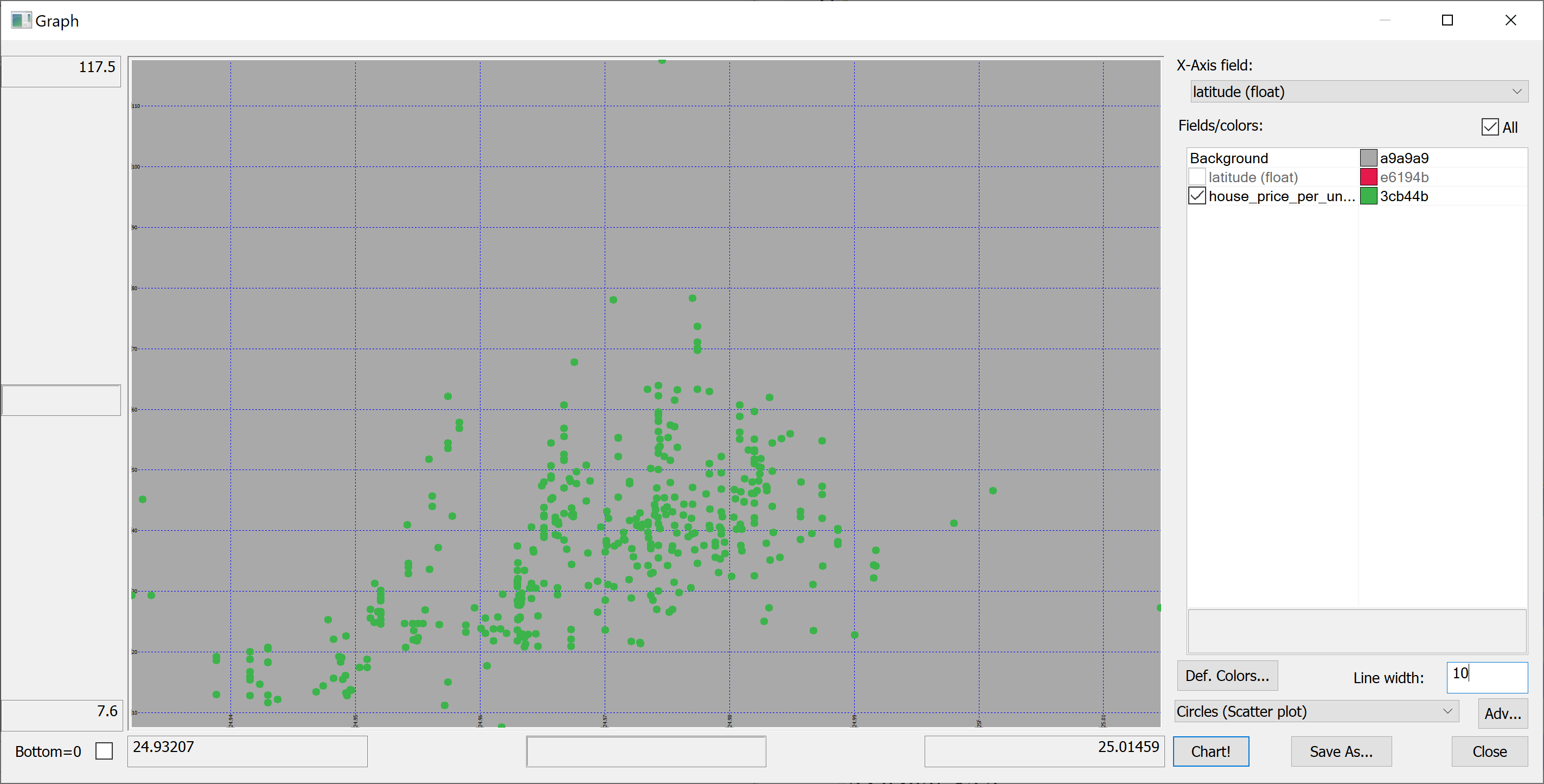

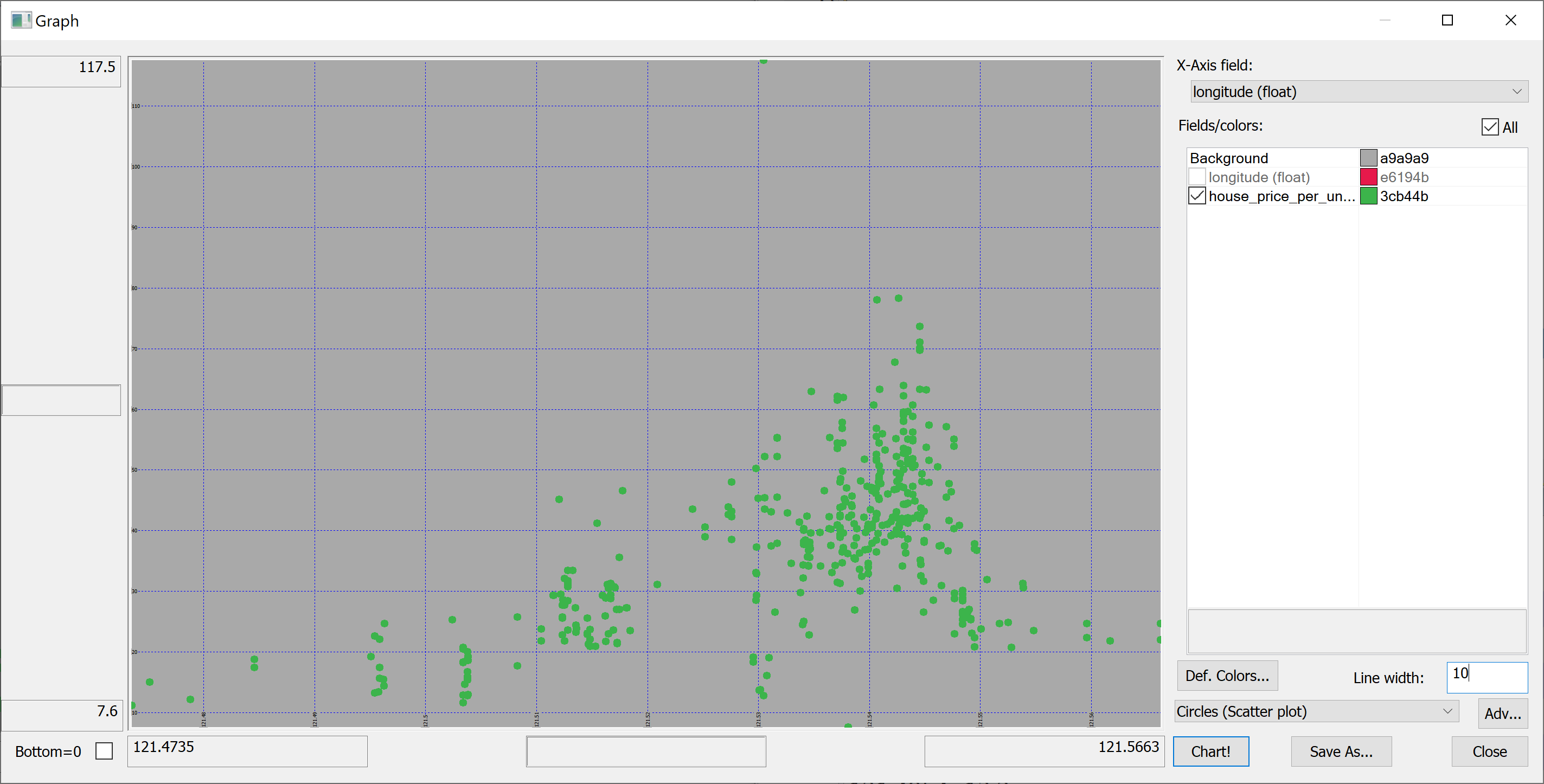

We are interested in predicting the house_price_per_unit_area using the various features present in our data set. Before we apply a machine learning algorithm, it is prudent to produce some scatter plots. The scatter plots could indicate whether each feature individually could help explain the house_price_per_unit_area.

select house_age,house_price_per_unit_area from t

select distance_to_nearest_mrt,house_price_per_unit_area from t

select number_of_convenience_stores,house_price_per_unit_area from t

select latitude,house_price_per_unit_area from t

select longitude,house_price_per_unit_area from t

Splitting the data

We are going to introduce some pseudorandomness, so it's a good idea to fix the seed to ensure reproducibility.

This can be done using the \S system command:

\S 42

We can now pseudorandomly shuffle the data:

n:count t; t:neg[n]?t;

Let us use half of the data set as the training set and the other half as the test set:

n_train:n div 2; n_test:n-n_train; t_train:n_train#t; t_test:neg[n_test]#t;

t_train and t_test are tables; we need matrices:

x_train:flip`float$t_train[-1_2_cols t_train]; y_train:raze t_train[-1#cols t_train]; x_test:flip`float$t_test[-1_2_cols t_test]; y_test:raze t_test[-1#cols t_test];

Linear regression using OLS

Suppose the data consists of observations . Each observation includes a scalar response and a column vector of regressors, i.e.

In general, . In a linear regression model, the response variable is a linear function of the regressors:

or in vector form,

where , as introduced previously, is a column vector of the th observation of all the explanatory variables; is a vector of unknown parameters; and the scalar represents unobserved random variables (errors) of the th observation. accounts for the influences upon the responses from sources other than the regressors . This model can also be written in matrix notation as

where and are vectors of the response variables and the errors of the observations, and is an matrix of regressors, also sometimes called the design matrix, whose row is and contains the th observations of all the explanatory variables.

How do we find the coefficients ?

Consider the overdetermined system

Such a system usually has no exact solution, so the goal is instead to find the coefficient which fit the equations "best". In ordinary least squares (OLS) this "best" is taken in the sense of solving the quadratic minimization problem

This minimization problem has a unique solution, provided that the columns of the matrix are linearly independent, given by solving the normal equations

The matrix is known as the normal matrix and the matrix as the moment matrix of regressand by regressors. Finally, is the coefficient vector of the least-squares hyperplane, expressed as

After we have estimated , the fitted values (or predicted values) from the regression will be

Let us implement OLS in q:

ols_fit:{[x;y]

ytx:enlist[y]mmu x;

xtx:flip[x]mmu x;

solution:ytx lsq xtx;

beta:first solution;

(enlist`beta)!enlist beta};

ols_predict:{[solution;x]

sum solution[`beta]*flip x};

lsq solves normal equations matrix via Cholesky decomposition; this is more robust than a combination of matrix inversion and multiplication.

Define the residuals as

(forming a vector ).

Let

be the mean of the observed data.

The variability of the data set can be measured with two sums of squares:

- the total sum of squares (TSS) (proportional to the variance of the data):

- the sum of squares of the residuals, also called the residual sum of squares (RSS):

It is common to assess the goodness-of-fit of the OLS regression by comparing how much the initial variation in the sample can be reduced by regressing onto . The coefficient of determination is defined as a ratio of "explained" variance to the "total" variance of the dependent variable :

In the best case, the modelled values exactly match the observed values, which results in and . A baseline model, which always predicts , will have . Models that have worse predictions than this baseline will have a negative .

Let us implement in q:

r_squared:{[y;y_pred]

tss:sum t*t:y-avg[y];

rss:sum t*t:y-y_pred;

(tss-rss)%tss};

Applying the OLS linear regression to our data set

We apply the OLS linear regression to our data set as follows:

model:ols_fit[x_train;y_train]; y_train_pred:ols_predict[model;x_train];

We obtain the in-sample of 0.4859935 (approx. 49%):

r_squared[y_train;y_train_pred]

How well are we doing out-of-sample? Surprisingly, better than in-sample:

y_test_pred:ols_predict[model;x_test]; r_squared[y_test;y_test_pred]

The resulting is 0.5986606 (approx. 60%).

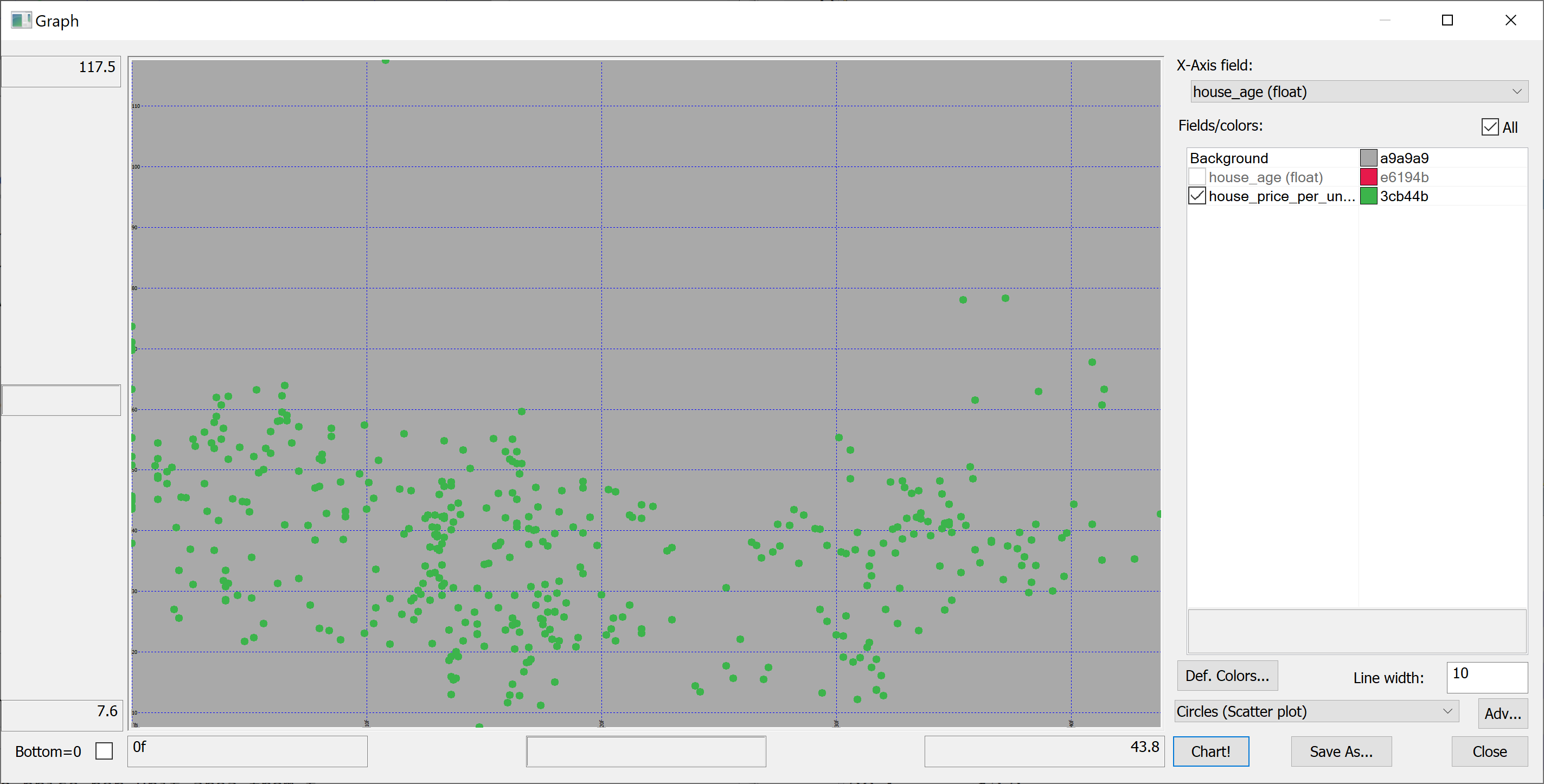

It is unusual for the out-of-sample to be better than the in-sample , but it may occasionally happen. Why did this happen in our case?

The answer is revealed by the scatter-plots.

In-sample:

flip `y_train`y_train_pred!(y_train;y_train_pred)

Out-of-sample:

flip `y_test`y_test_pred!(y_test;y_test_pred)

On the in-sample scatter plot we see the outlier (the rightmost point on the plot). This outlier is likely affecting the in-sample . Let's find this outlier:

select from t_train where (max abs y_train_pred-y_train)=abs y_train_pred-y_train

no transaction_date house_age distance_to_nearest_mrt number_of_convenience_stores latitude longitude house_price_per_unit_area -------------------------------------------------------------------------------------------------------------------------------- 271 2013.333 10.8 252.5822 1 24.9746 121.5305 117.5

This outlier corresponds to a property with an unusually high house_price_per_unit_area. We can even find this property on Google Maps (by entering the latitude and longitude).

Let's remove this outlier:

delete from `t_train where (max abs y_train_pred-y_train)=abs y_train_pred-y_train; x_train:flip`float$t_train[-1_2_cols t_train]; y_train:raze t_train[-1#cols t_train];

Now let's repeat the fitting procedure:

model:ols_fit[x_train;y_train]; y_train_pred:ols_predict[model;x_train]; r_squared[y_train;y_train_pred]

Now we obtain the in-sample of 0.5706795 (approx. 57%). What about out-of-sample?

y_test_pred:ols_predict[model;x_test]; r_squared[y_test;y_test_pred]

0.5941468 (approx. 59%). Still (somewhat surprisingly) greater than in-sample, but much closer.

Combining q and Python: improving on OLS

Can we do better than that?

For some things q is perfect (e.g. working with big data), whereas others are best reserved for Python (and especially its excellent machine learning libraries). We'll now use Python to improve on the results of the OLS regression.

We'll use the qpython module to interact with q from Python. We install it using

pip install qpython

XGBoost is advertised as

an optimized distributed gradient boosting library designed to be highly efficient, flexible and portable. It implements machine learning algorithms under the Gradient Boosting framework. XGBoost provides a parallel tree boosting (also known as GBDT, GBM) that solve many data science problems in a fast and accurate way. The same code runs on major distributed environment (Hadoop, SGE, MPI) and can solve problems beyond billions of examples.

Wikipedia tells us that gradient boosting

is a machine learning technique for regression, classification and other tasks, which produces a prediction model in the form of an ensemble of weak prediction models, typically decision trees. When a decision tree is the weak learning, the resulting algorithm is called gradient boosted trees, which usually outperforms random forest. It builds the model in a stage-wise fashion like other boosting methods do, and it generalizes them by allowing optimization of an arbitrary differentiable loss function.

Let's install XGBoost:

pip install xgboost

We start a Jupyter notebook and import the following Python modules:

import numpy as np import qpython.qconnection import sklearn.metrics import xgboost

We want Python to be able to talk to kdb+/q. To this end, in q, we open a port:

\p 41822

We connect to this port from the Python side:

q = qpython.qconnection.QConnection('localhost', 41822, pandas=True)

q.open()

We fetch the data set from q to Python:

x_train = np.array(q('x_train'))

y_train = np.array(q('y_train'))

x_test = np.array(q('x_test'))

y_test = np.array(q('y_test'))

We then create an XGBoost model with default parameters (let's see how well XGBoost works out of the box):

model = xgboost.XGBRegressor()

and fit this model to the data:

model.fit(x_train, y_train)

The model is then used to obtain the predictions y_train_pred:

y_train_pred = model.predict(x_train)

How good is the fit? What is our in-sample ?

sklearn.metrics.r2_score(y_train, y_train_pred)

The result is

0.9955447127025048

Of course, we are interested in the out-of-sample, rather than in-sample, performance of the model. Let's apply the model to the test set:

y_test_pred = model.predict(x_test)

What's our out out-of-sample ?

sklearn.metrics.r2_score(y_test, y_test_pred)

0.7187695555297899

The out-of-sample of about 72% is significantly better than that produced using the OLS regression.