Finance

History

The origins

Josseph de la Vega's (ca. 1650 – Amsterdam, November 13, 1692) Confusion de Confusiones [V88] was published in 1688. It is the oldest book ever written about stock exchanges. It predates Saeed Amen's Trading Thalesians by 326 years!

Written in Spanish by a member of the Sephardi community of Amsterdam in the form of four dialogues between a philosopher, a merchant, and a shareholder, it focusses on the activities of the Amsterdam bourse in the second half of the 17th century.

The author clearly appreciates the importance of (different kinds of) information in the price formation process:

The price of the shares is now 580, [and let us assume that] it seems to me that they will climb to a much higher price because of the extensive cargoes that are expected from India, because of the good business of the Company, of the reputation of its goods, of the prospective dividends, and of the peace in Europe.

Furthermore,

The expectation of an event creates a much deeper impression upon the exchange than the event itself. When large dividends or rich imports are expected, shares will rise in price; but if the expectation becomes a reality, the shares often fall; for the joy over the favourable development and the jubilation over a lucky chance have abated in the meantime.

Volatility

The term volatility is a relatively recent arrival. It originates from the Latin word volatilitas — "readiness to fly swiftly on" (from volo, "to fly") [C92].

We find an unflattering passage describing Louis Napoléon Bonaparte (1808 – 1873) in an 1863 journal [K63]

He was a buyer and seller of those fractional and volatile interests in trading adventures, which go by the name of "Shares," and since it has chanced that the nature of some of his transactions has been brought to light by the public tribunals, it is probable that the kind of repute in which he is held may be owing in part to those disclosures.

In 1915, Wesley Clair Mitchell (1874 – 1948) studied what he referred to as fluctuations in commodity prices [M15]. He was the first person [M63, H08] to empirically show the existence of fat-tailed distributions and time-varying volatility in price data.

In the context of financial markets, the term volatility reappears in 1935 in Harold M. Gartley's (1899 – 1972) early work [G35] on technical analysis.

The first mathematical model for the volatility (which he called le coefficient d'instabilité) of asset prices was proposed earlier and is due to Louis Jean-Baptiste Alphonse Bachelier (1870 – 1946). In his 1900 thesis [B00], he modelled the asset prices as a simple symmetric random walk and, in the limit, Brownian motion.

Fischer Black and Myron Scholes [BS73] model the asset price as a GBM with constant percentage volatility,

equivalently, they model the log-price as a Wiener process with drift and infinitesimal variance :

One of the "ideal conditions" assumed by them:

The variance rate of the return on the stock is constant.

As mentioned previously, some early evidence for time-varying volatility was provided by Mitchell in 1915 [M15]. See [H08] for details.

In his 1962/3 article [M63], Benoit B. Mandelbrot (1924 – 2010) observed that

...the movement of prices in periods of tranquillity seem to be smoother than predicted by my process. In other words, large changes tend to be followed by large changes — of either sign — and small changes tend to be followed by small changes...

and quoted the earlier empirical observations by Mitchell [M15] and others.

This stylized fact, known as volatility clustering, is one of several (see [C01]) that have motivated the search for more realistic models for volatility dynamics.

The leverage effect

Another stylized fact, highlighted in [BS73] is the relation between stock returns and changes in volatility:

I have believed for a long time that stock returns are related to volatility changes. When stocks go up, volatilities seem to go down; and when stocks go down, volatilities seem to go up. The extreme example of this is the depression of the 30's. Stocks went way down, and volatilities went way up.

The term leverage effect refers to thus observed negative correlation between changes in asset prices and changes in volatility. The term takes its origin in the following explanation suggested by Black [BS73]:

A drop in the value of the firm will cause a negative return on its stock, and will usually increase the leverage of the stock.

Whether or not (and to what extent) the leverage effect is due to leverage is debatable, see e.g. [S89]:

While aggregate leverage is significantly correlated with volatility, it explains a relatively small part of the movements in stock volatility. The amplitude of the fluctuations in aggregate stock volatility is difficult to explain using simple models of stock valuation, especially during the Great Depression.

Buy low, sell high

Wiktionary refers to "buy low, sell high" as

Commonplace investment advice, recommending that a prospective investor purchase an asset at a low cost and sell it later for a high price.

It adds:

Often used in a humorous manner, since this advice is too trite and vague to be helpful in specific situations.

Thales of Miletus (c. 626/623 BC – c. 548/545 BC) is probably the earliest adopeter of this advice. According to Aristotle, Politics 1.1259a,

Thales, so the story goes, because of his poverty was taunted with the uselessness of philosophy; but from his knowledge of astronomy he had observed while it was still winter that there was going to be a large crop of olives, so he raised a small sum of money and paid round deposits for the whole of the olive-presses in Miletus and Chios, which he hired at a low rent as nobody was running him up; and when the season arrived, there was a sudden demand for a number of presses at the same time, and by letting them out on what terms he liked he realized a large sum of money, so proving that it is easy for philosophers to be rich if they choose, but this is not what they care about.

Although, ibid., Aristotle draws a different conclusion from this story:

Thales then is reported to have thus displayed his wisdom, but as a matter of fact this device of taking an opportunity to secure a monopoly is a universal principle of business; hence even some states have recourse to this plan as a method of raising revenue when short of funds: they introduce a monopoly of marketable goods.

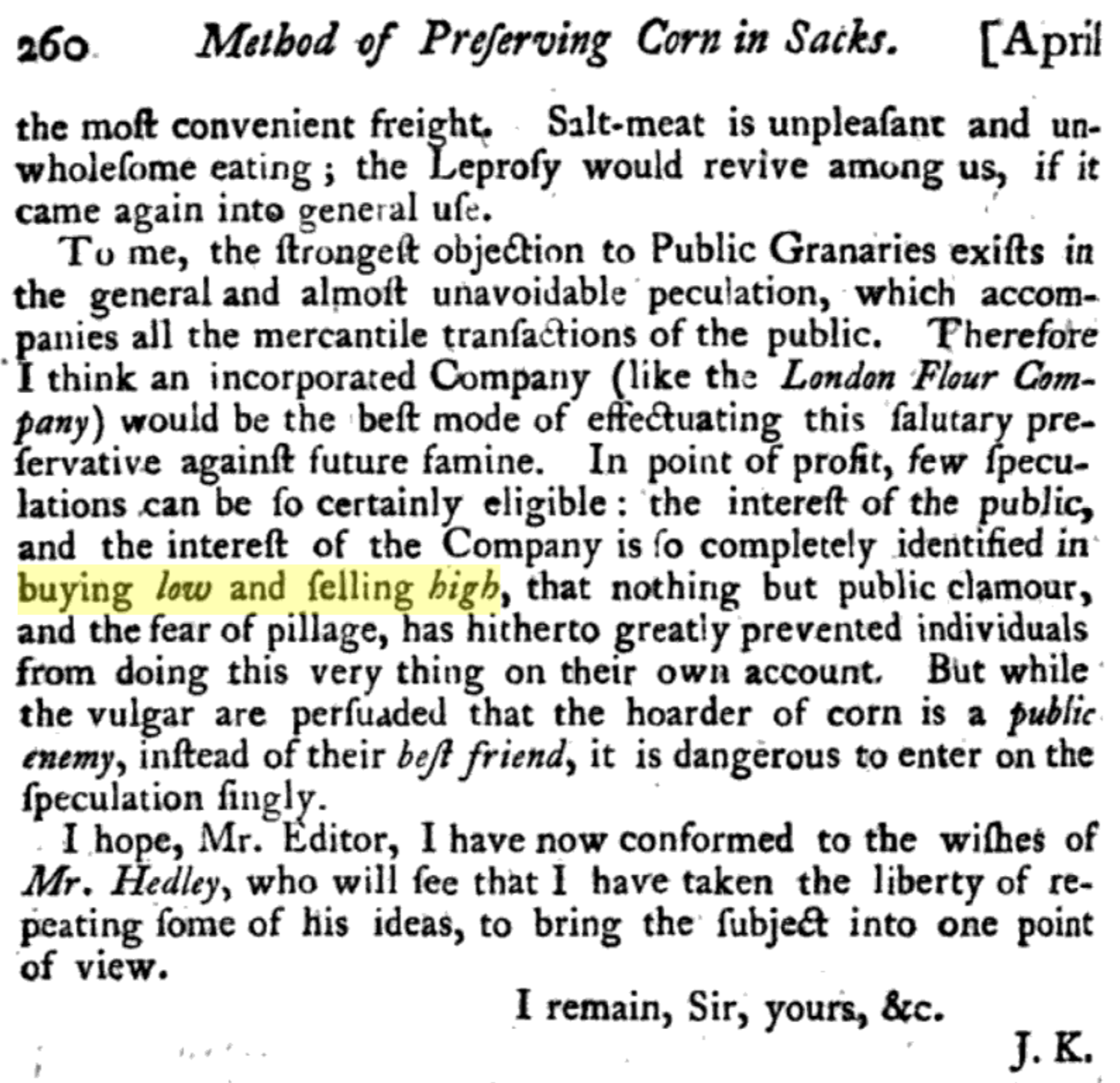

The earliest reference that we could find to the adage "buy low, sell high" in the literature was in the letter ON PRESERVING CORN IN GRANARIES written by a certain J. K. "To the Editor of the Commercial and Agricultural Magazine" for 1801, Vol. IV, from December to June, inclusive, printed and published by Vaughan Griffiths, Paternoster-Row:

Bibliography

- [B00] Louis Jean-Baptiste Alphonse Bachelier. Théorie de la spéculation. Annales Scientifiques de l'École Normale Supérieure, 1900, 3, 21-86.

- [B76] Fischer Black. Studies of stock price volatility changes. Proceedings of the Business and Economic Statistics Section, American Statistical Association, 1976.

- [BS73] Fischer Black and Myron Scholes. The Pricing of Options and Corporate Liabilities. Journal of Political Economy, 1973, 81(3), 637-654.

- [C01] Rama Cont. Empirical properties of asset returns: stylized facts and statistical issues. Quantitative Finance, 2001, 1, 223-236.

- [C92] George Crabb. English Synonymes Explained in Alphabetical Order. Harper & Brothers, Publishers, 1892.

- [G35] Harold M. Gartley. Profits in the Stock Market. Health Research Books, 1935.

- [H08] Espen Gaarder Haug. Derivatives: Models on Models. Wiley, 2008.

- [K63] Alexander William Kinglake. Napoléon Bonaparte. The Living Age, April 1863, 983.

- [M63] Benoit B. Mandelbrot. The variation of certain speculative prices. Journal of Business, 1963, XXXVI, 392-417.

- [M15] Wesley Clair Mitchell. The Making and Using of Index Numbers: Introduction to Index Numbers and Wholesale Prices in the United States and Foreign Countries, Bulletins of the U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, 1915, 173.

- [S89] G. William Schwert. Why Does Stock Market Volatility Change Over Time? The Journal of Finance, 1989, XLIV, 1115-1153.

- [V88] Josseph de la Vega. Confusion de Confusiones: Dialogos Curiosos Entre un Philosopho agudo, un Mercaderdiscreto, y un Accionista erudito. Amsterdam, 1688.